A Digital Wallet with Expense Analysis

Industry

Type

Time

Platforms

Project idea

Our client is a fintech startup that came to us with an idea for a digital wallet that will help people make quick payments, track their income/expenses, and provide financial advice to those who want it. The app should also have the ultimate level of security to protect the clients’ sensitive information.

We were responsible for

Backend development

Frontend development

UX/UI design

Technology stack

Example 2

Development process step by step

Target audience research

Creating user personas

Competitive analysis

Wireframing

UX/UI design

Interactive prototype

Backend development

Frontend development

Security integration

Test automation

Manual testing

Bug-fixing

Legal compliance

Pre-release preparation

Product launch in App Store

Post-release support

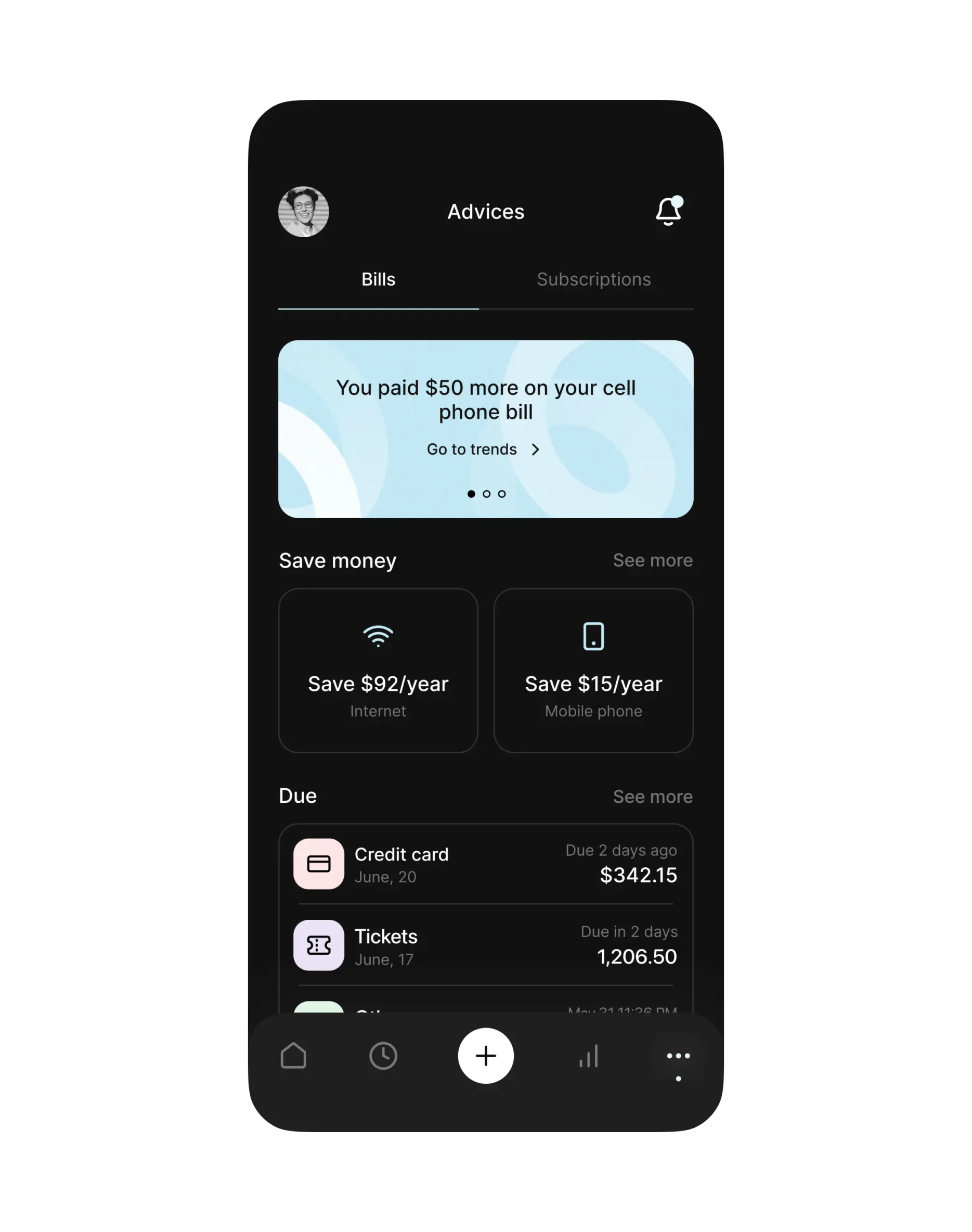

Features in detail

Budgeting tools

The app securely stores transaction history, analyzes a user’s spending, and provides them with detailed statistics about their buying behavior.

Recurring payments

The wallet will remind a user about upcoming payments like bills (utilities, rent, tuition, and more), subscriptions, or charity donations.

Payments and money transfers

The app allows users to make P2P payments and money transfers from one account to another, as well as transfers to and from bank accounts. The app relies on bank account integration to allow users to make P2P payments and money transfers from one account to another and to make transfers to and from bank accounts.

Financial advice

The application analyzes payments made by the user, categorizes them, and provides real-time statistics of user spending. If a user wants to receive financial advice about their spending, investments, or other financial issues, they can access the content library where they can find the materials they need.

Challenges and solutions

Access to an account for young users

Challenge: Allowing young users to transfer money through an e-wallet gives minors the opportunity to manage their own money. A lot of current market solutions don’t allow people under 18 to use their e-wallet, but giving them access to money will instill financial literacy.

Solution: We’ve made it a bit more user-friendly for teens. We’ve added a restriction for minors. The young person's account is linked to the parent's account. The parent sets a limit and replenishes the balance. At the same time, the parent has in their personal account the opportunity to view the child’s account history of payments and transfers. Thewallet's payment system is available for kids as young as 13, and it's one of the few mobile options that allows a young person to pay someone else or receive funds.

Financial advice based on user transactions

Challenge: It was necessary to display not universal tips to the user, but custom tips, depending on their personal transactions and payment history.

Solution: We added AI and special programs which look at user data, analyze it, and display tips depending on the user’s data. All information and advice is developed by financial analysts. Some of the tips are displayed as a notification and some are delivered through the chatbot.