Automating Claims Documentation for an InsurTech SaaS Company

Making insurance claim processing faster and more efficient with AI

AI development

Insurance

9 weeks

Web

About the project

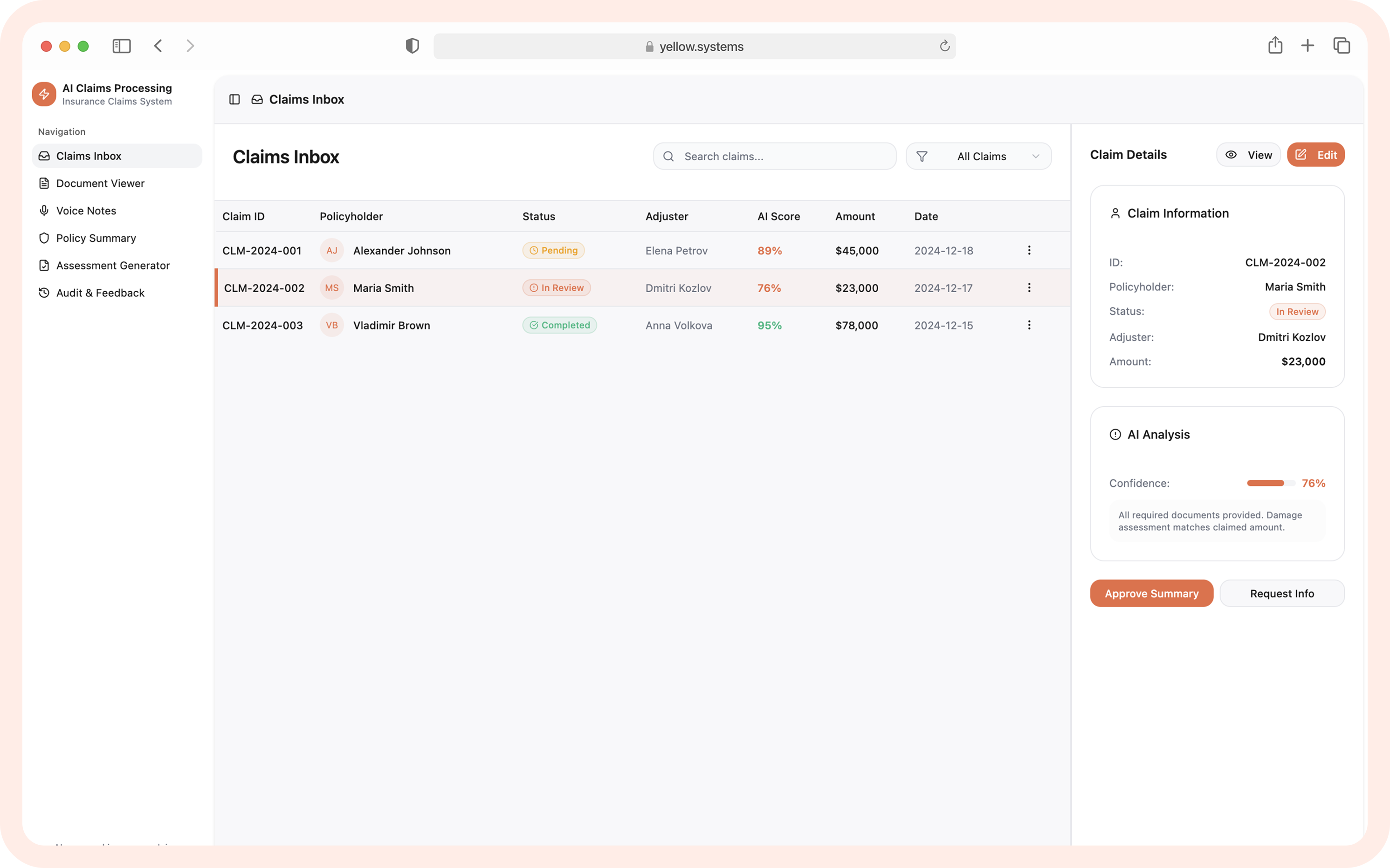

Our client is a US-based Insurtech company that offers a SaaS platform for insurance brokers and claims adjusters. Their goal is to reduce the administrative burden on insurance professionals by automating claims documentation, one of the most repetitive and time-intensive tasks in the industry. They wanted their platform to automatically extract relevant data from claim documents, summarize policy details, and generate initial claim assessments based on voice notes and uploaded forms.

The client had

A working SaaS platform

Document upload and voice memo features

Limited in-house AI expertise and development bandwidth

We were responsible for

AI/NLP pipeline for document and voice input analysis

Backend/API integration with insurance databases

Frontend updates to display AI-generated summaries and claim suggestions

Project Team

Project manager

UX/UI designer

Full-stack engineer

AI engineer

QA engineer

DevOps

Conceptual flow diagram

AI-Powered claims documentation automation.

Input Sources (User Actions)

Uploaded Claim Forms, Voice Notes, Attachments and Supporting Docs

Intelligent Data Extraction

NLP + OCR, Extracts policyholder info, Pulls out claim details, Interprets audio notes

Automated Understanding & Structuring

Summarization of Policy Terms, Classification of Claim Types, Tagging Key Events & Entities

Initial Claim Assessment

Draft Claim Summary, Risk Flags / Coverage Checks, Actionable next steps for adjuster

Output

Structured Claim Document, Internal System Notes, Feedback Loop for Adjuster Input

Scope of work

To bring the solution to life, we followed a structured development process tailored to the client’s domain. Below is a breakdown of the key stages involved, from initial feasibility assessment to full system integration.

Requirements gathering and feasibility study

AI/NLP model selection and fine-tuning

Custom prompt engineering for insurance-specific language

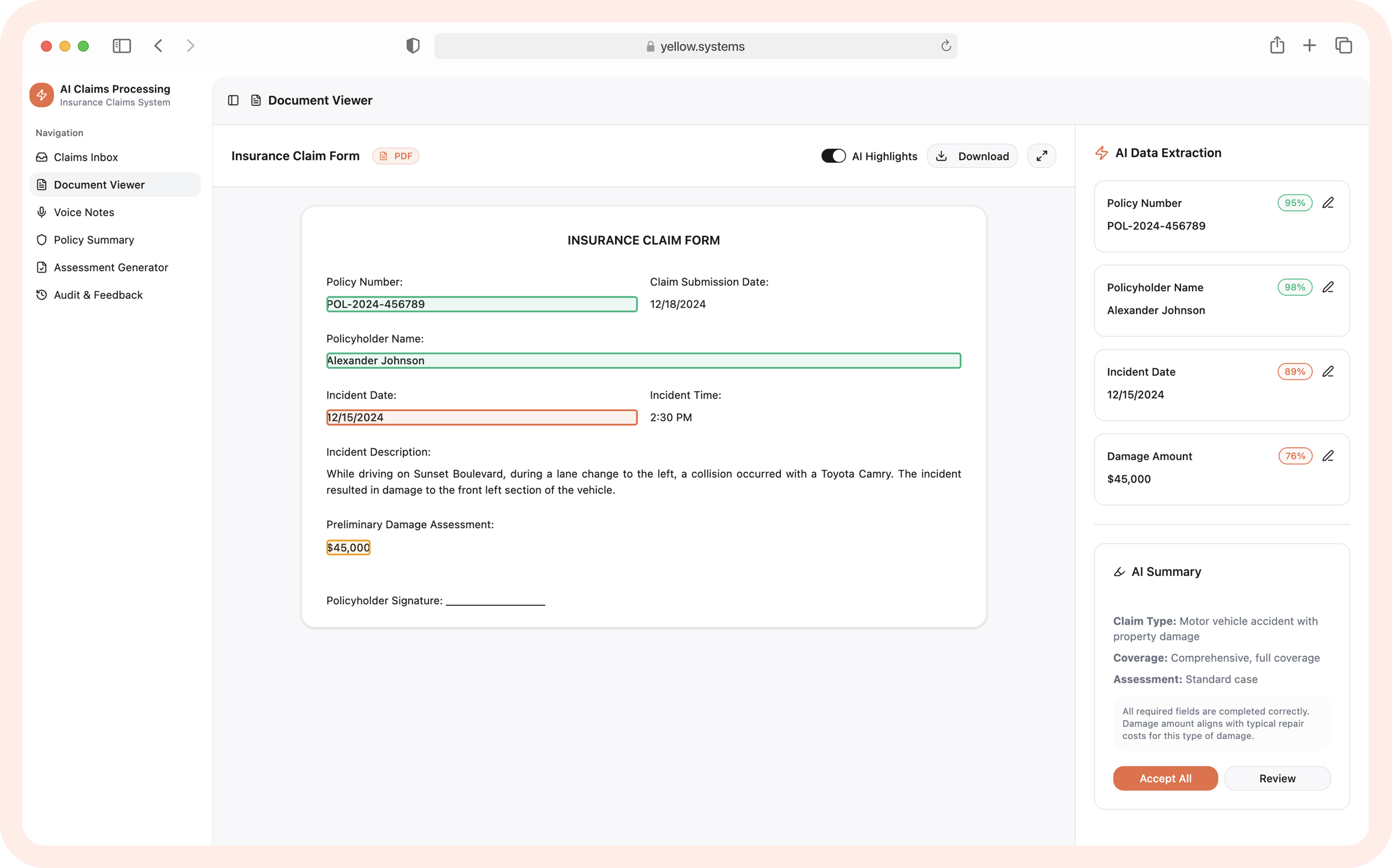

Voice-to-text pipeline integration for recorded claim statements

Auto-generation of claim summaries and recommendations using LLMs

Integration with insurance policy and claims management systems

Web UI for review/editing of AI-generated claim drafts

Data security measures and compliance with insurance data standards

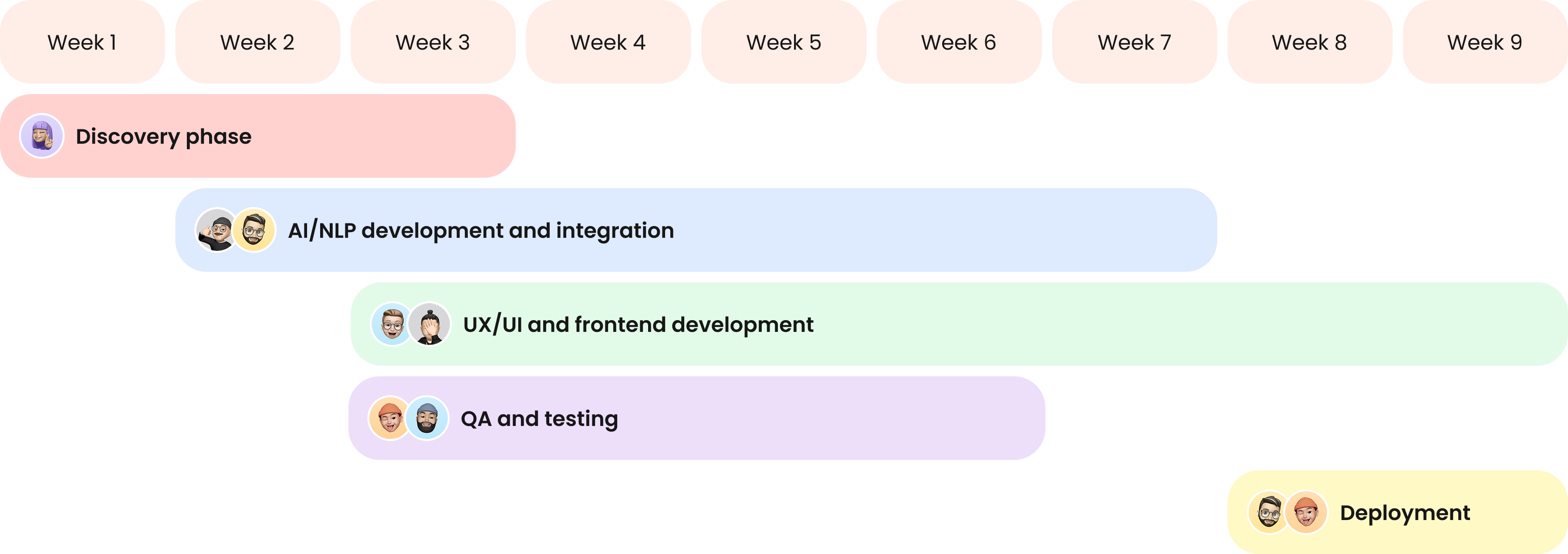

Project timeline

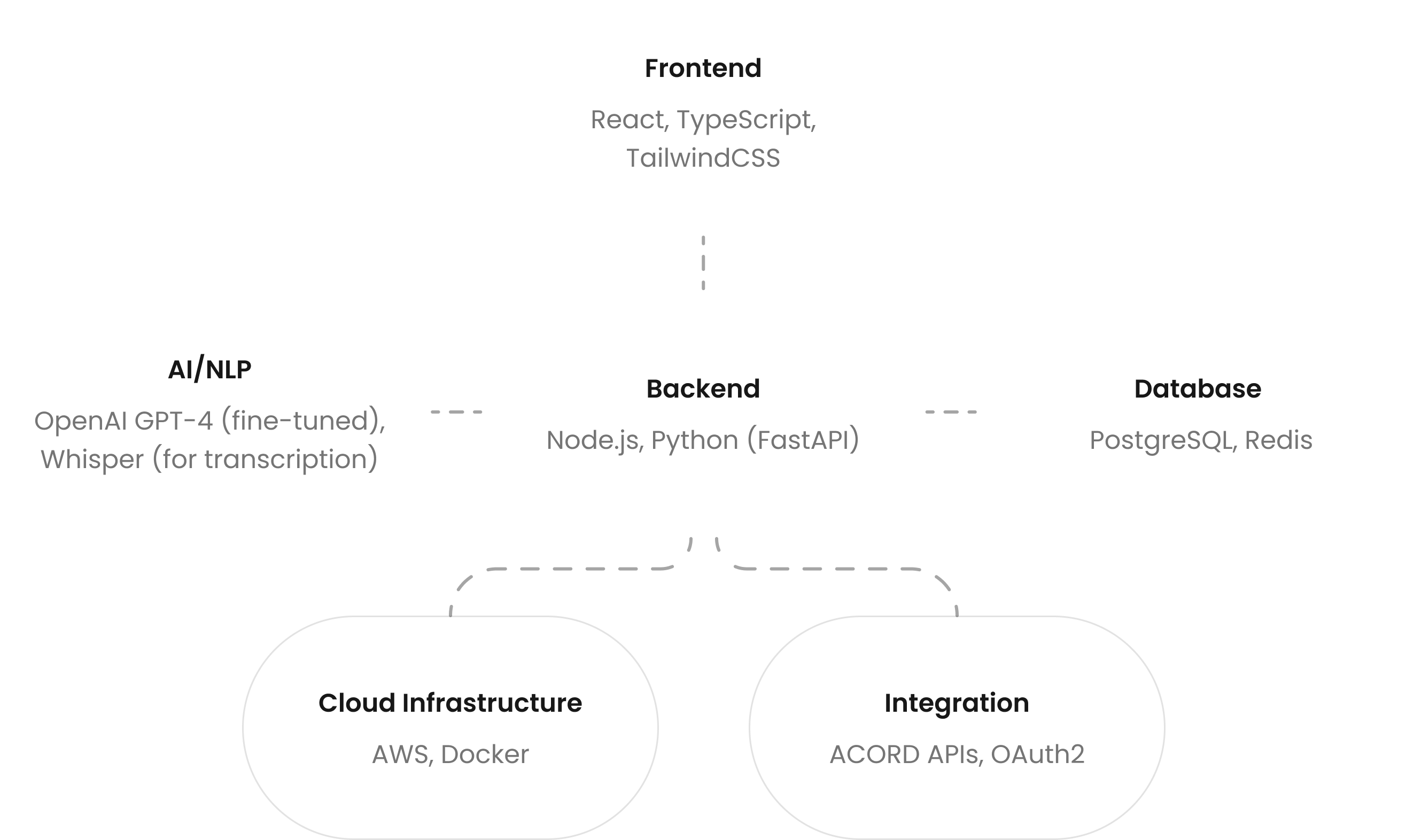

Tech stack

The technologies we used to realise the LLM integration smoothly.

Development challenges and solutions

How our team dealt with a range of development challenges.

Accurate transcription of claim interviews

Challenge: Insurance claim interviews often involve poor audio quality, with a lot of background noise and overlapping voices. Standard transcription models struggle with domain-specific vocabulary, and out-of-the-box solutions frequently misinterpret critical phrases.

Solution: We fine-tuned Whisper with call center audio samples and enriched the output using domain-specific insurance terms. This customization allowed the system to adapt to noisy conditions and speech patterns. The result was more precise transcriptions that reduced the need for manual correction and editing.

Reliable claim summary generation

Challenge: While AI-generated summaries helped speed up claims review, early AI outputs were too generic or included irrelevant details, especially for complex multi-party claims. This created a risk of misinterpretation and slowed decision-making.

Solution: We used structured prompts that enforced policy-aware summarization and added confidence scoring. This approach reduced manual review time, improved accuracy, and provided users with clear and actionable summaries.

Result

By combining LLM-powered AI with deep insurance domain adaptation, we streamlined one of the most repetitive parts of the claims process. The resulting automation now plays a central role in reducing manual overhead for claims adjusters and speeding up case turnaround time.