Mobile Budgeting App for Small Businesses

An iOS application for small businesses to manage their finances

Fintech

6+ months

Mobile development

iOS

About project

The client approached us with an idea of a digital budgeting assistant for small business owners. A lot of small businesses struggle with managing their finances, especially at the very beginning of their work. To facilitate this process, our client wanted to build a mobile solution that will make it easier for business owners.

The client had

Idea

Old wireframes

We were responsible for

Backend development

Frontend development

UX/UI design

Project team

- Project manager

- UX/UI designer

- Frontend engineer

- Backend engineer

- QA engineer

Discovery phase

Before the full-scale development process started, we completed the discovery phase to find out more about the market and target audience.

Aaron, 35 y.o.

Experienced small business owner

Aaron has owned two local coffee shops for three years. He has several employees who work at them, but he is the one responsible for accounting. Recently he has begun having trouble with financial documentation. However, he cannot afford to hire a full-time accountant.

Aaron wants a simple solution that will help him sort out all his financial processes.

Olive, 24 y.o.

Has just started her own business

Olive opened the flower shop of her dreams a month ago. She read a lot of literature about finances and business management, but she lacks practical experience. It’s time to pay taxes for the first time as a business owner, but she is in all the documentation.

Olive wants a mobile app that can help her easily track finances and that will have the necessary information about financial management.

Small business statistics

0

of small businesses face financial challenges. (Semrush)

0

of businesses fail because of inconsistent or insufficient cash flow. (Fundera)

0

of businesses aren’t able to receive the funding they need. (NSBA)

0

of small businesses fail because they lack a business model. (CBInsights)

The app is based on the following technologies:

Programming language: Swift 5

Architecture: MVVM + C

Localization: SwiftGen

Local Database: CoreData

Crash Analytics: Firebase Crashlytics

App Distribution: Fastlane, TestFlight, Firebase App Distribution

Chat: Twilio

UI: UIKit + SnapKit

REST API: Alamofire, Swagger Codegen

Code style and conventions: SwiftLint

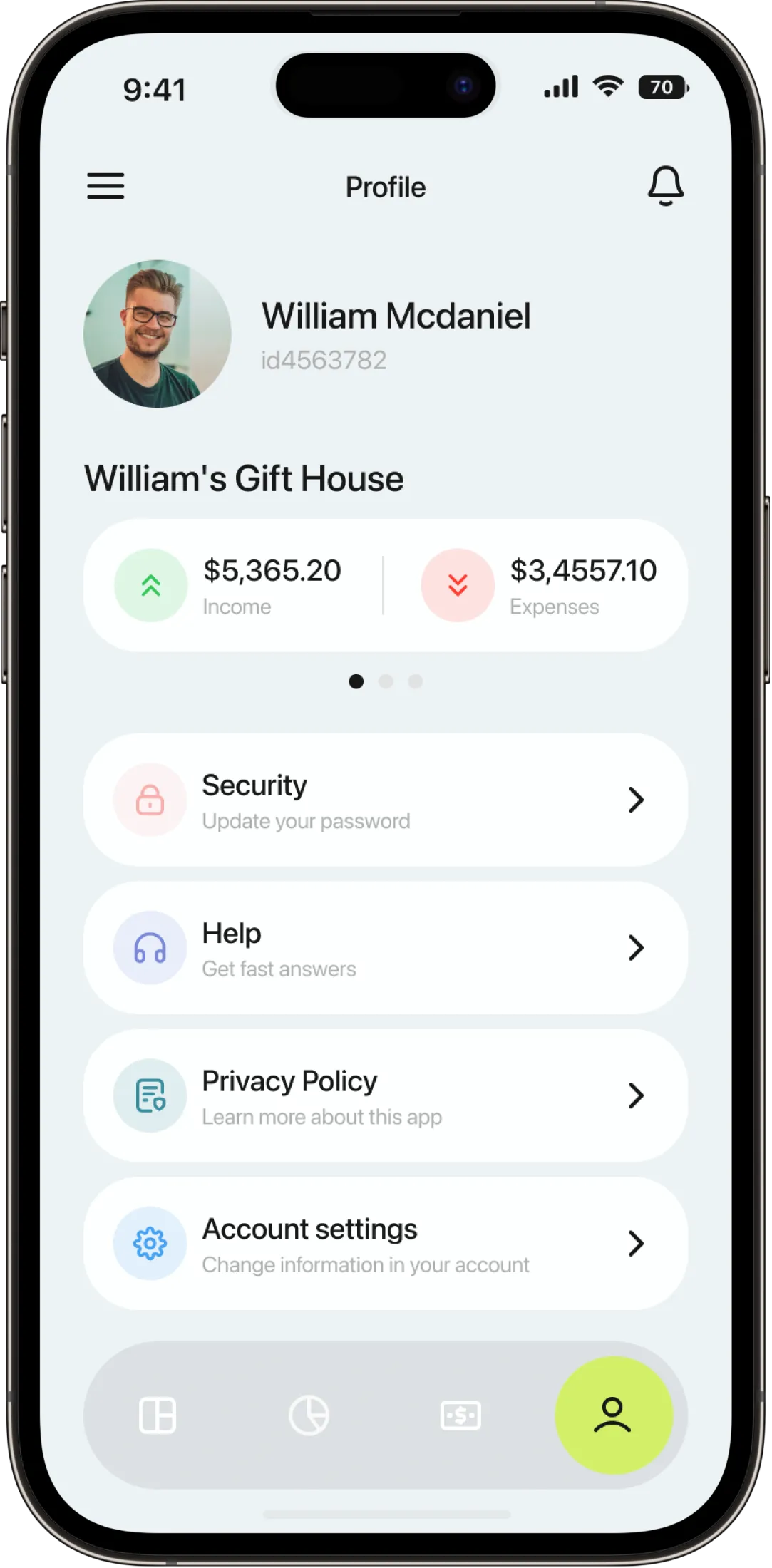

Profile

To register in the app, a new user has to complete a multi-step verification process that includes identification by selfie, confirmation of address, and an identification document that includes a photo.

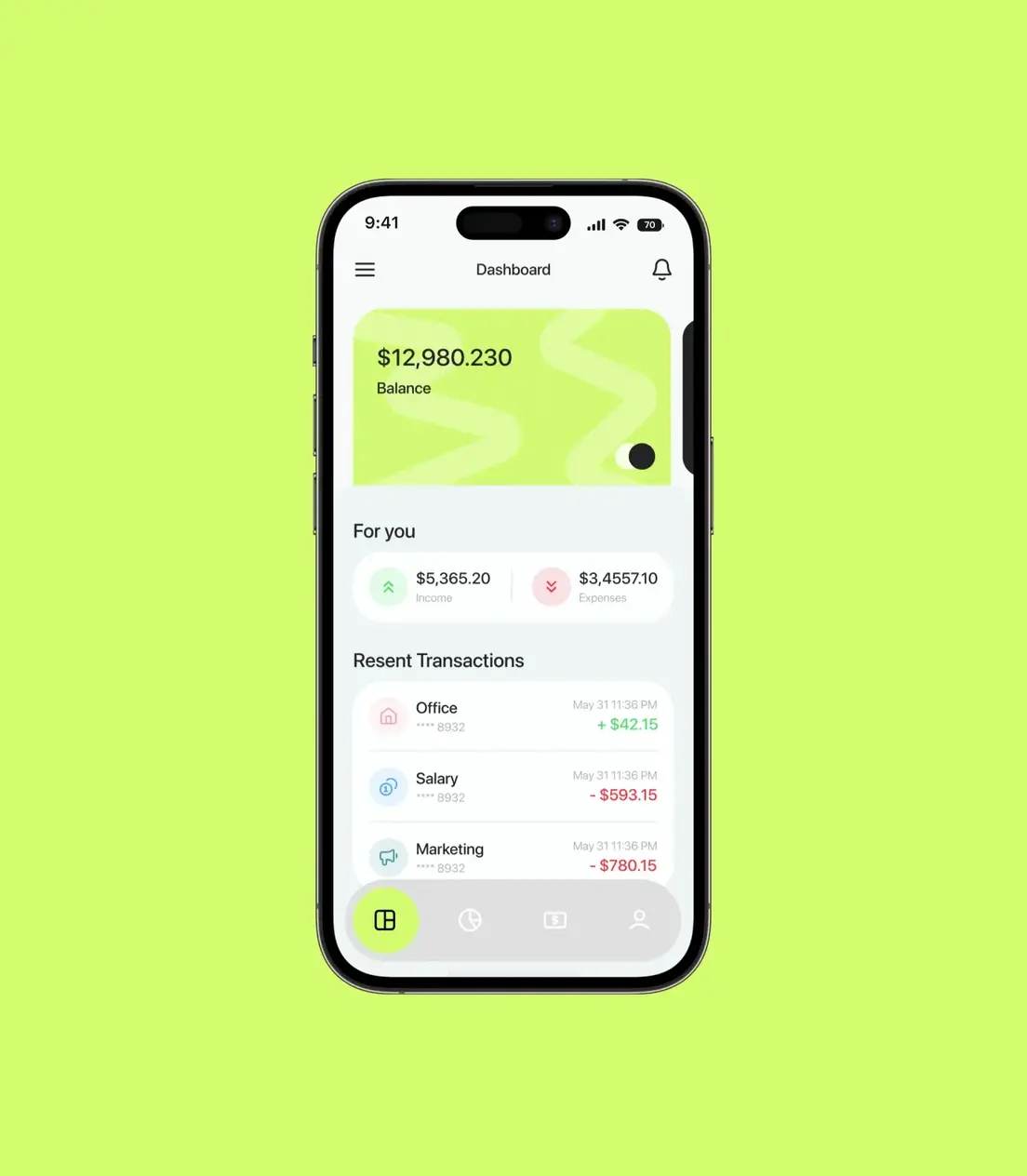

Dashboard

The Dashboard screen displays the most important stats about the financial status of your business. You can customize it to prioritize the stats

Expenses and income

You can customize the necessary categories of expenses and income sources depending on your business needs. Also, you can set up recurring payments to facilitate budgeting.

Transaction receipts

The app will store the receipts from your transactions so you will be able to quickly find the necessary one.

Reports and analytics

Track your weekly, monthly, quarterly, and yearly stats, compile financial reports and send them to your employees.

Chatbots

A simple and friendly chatbot will answer your questions about managing business finances and legal issues.

Taxation

A business owner can see what taxes they have to pay and calculate the exact amount.

Margin

Users can count how efficiently their goods and services are sold to see if any changes to the business strategy are needed.

Here are

the main challenges

we faced during the budget app development and

the ways we solved

them.

Offline mode

Challenge:

Users should always have access to the app regardless of Internet connection.

Solution:

We made a logic for user data to cache on the device if the Internet connection is off. All requests will be queued and synchronized with the backend once the user is online again.

Data synchronization

Challenge:

All user data should be synchronized between different devices if the device is changed or the user deletes the app.

Solution:

We used a custom backend for storing and managing user data to avoid situations where the data could be erased.

Chat security

Challenge:

The chat and all the data sent in messages should be protected from any third-party interference.

Solution:

We implemented an end-to-end message encryption algorithm to ensure data privacy.