Web Platform for Easy P2P Loans

A P2P lending platform that makes loan operations easy

Project idea

Our client is a medium-sized loan firm based in New York. They approached us with the idea of a peer-to-peer platform that will make the lending process as easy as possible. Their main requirements were intuitive design, the maximum level of automation, and top-level security measures.

Industry: Fintech

Type: Web development

Time: Ongoing

Platforms: Web

About the project

Project team

Project manager

UX/UI designer

Two frontend engineers

Two backend engineers

QA engineer

The client had

The initial idea

We were responsible for

The platform’s design

Frontend development

Backend development

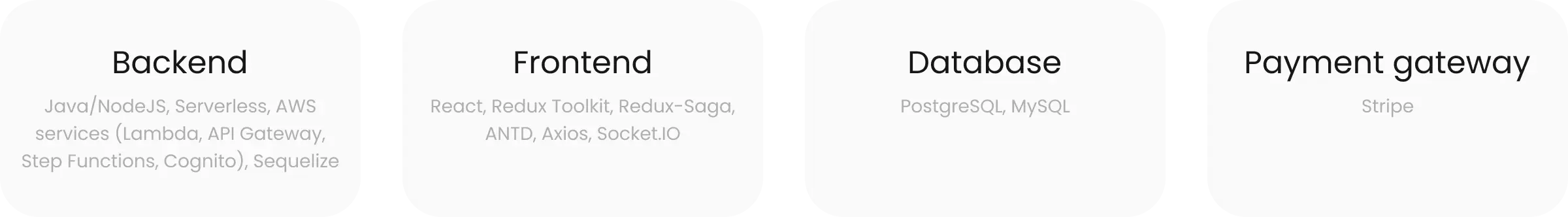

Technology stack

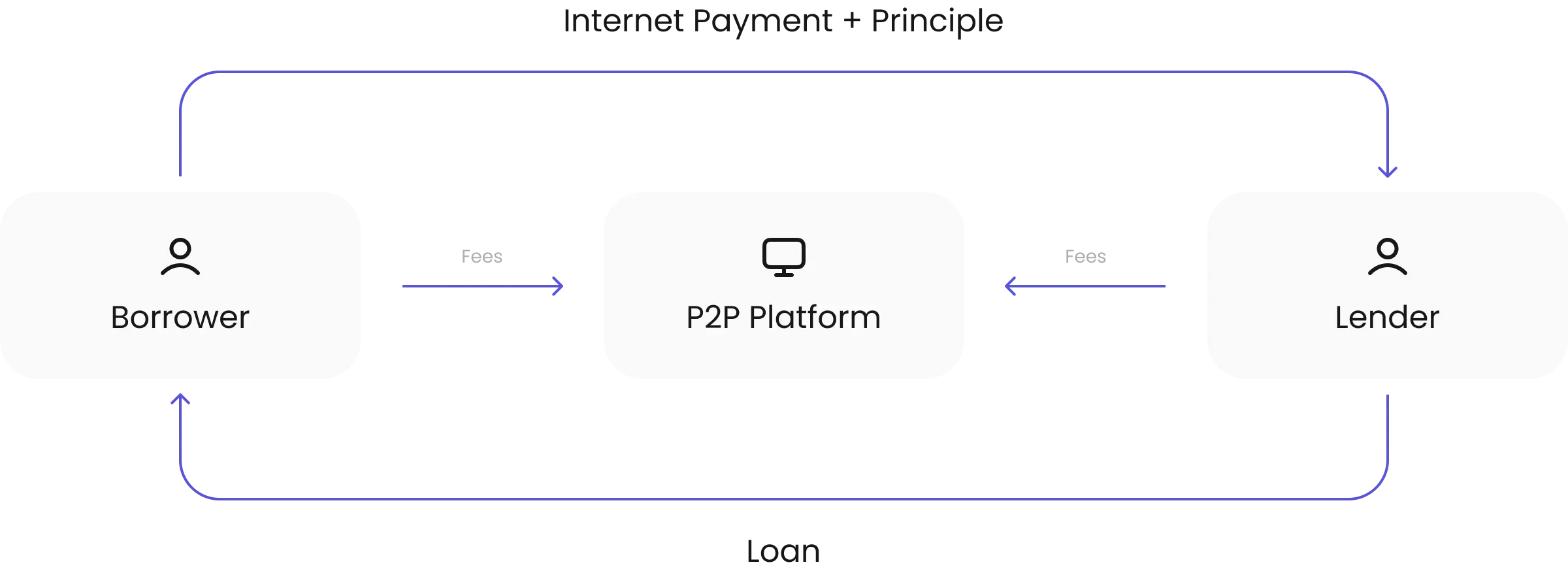

How Peer-to-Peer lending works

Features in detail

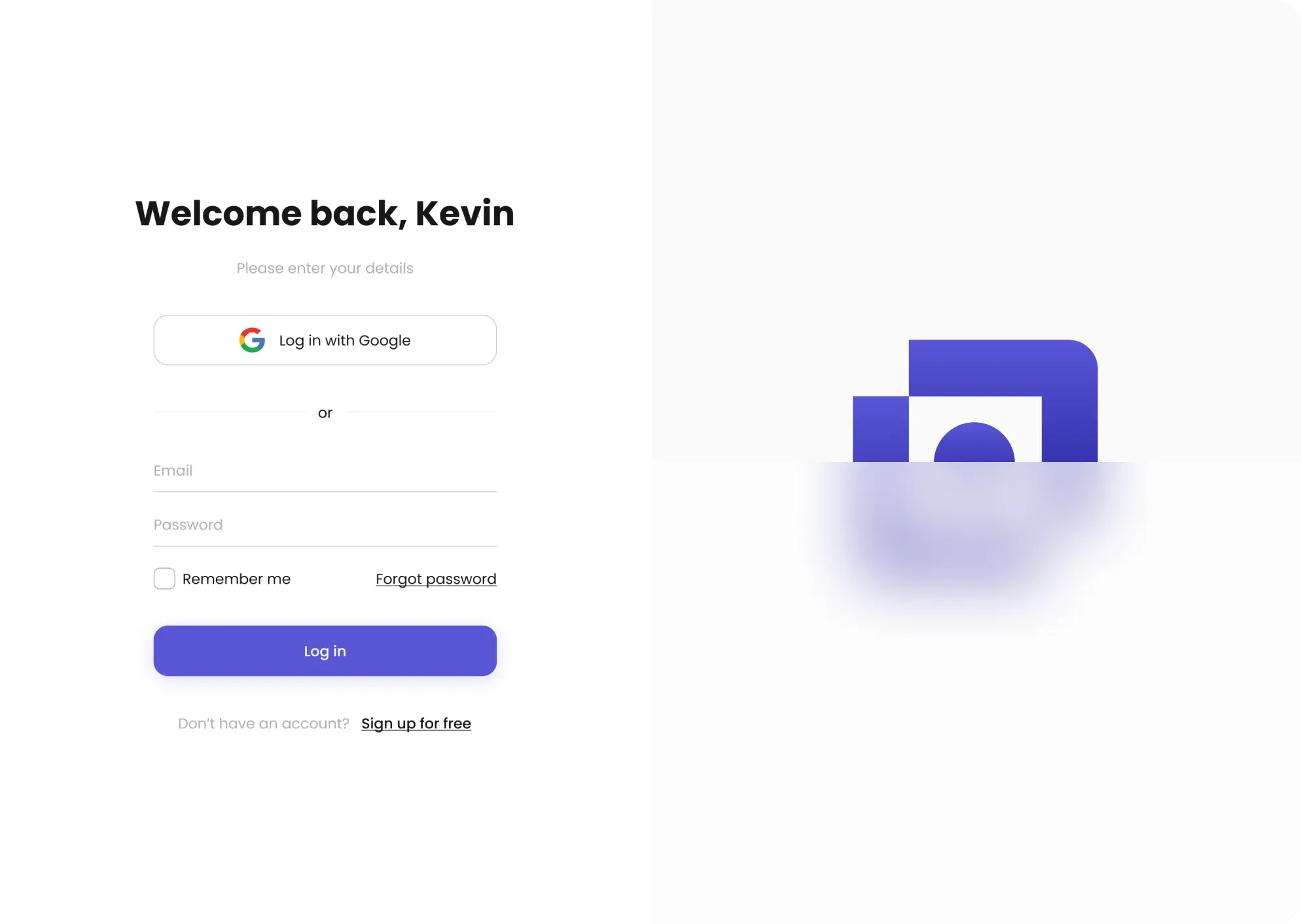

Secure sign up/sign in

When a lender or borrower registers on the platform, they start with a simple sign-up and onboarding. Then, users can implement two-factor authentication to secure their sign-in.

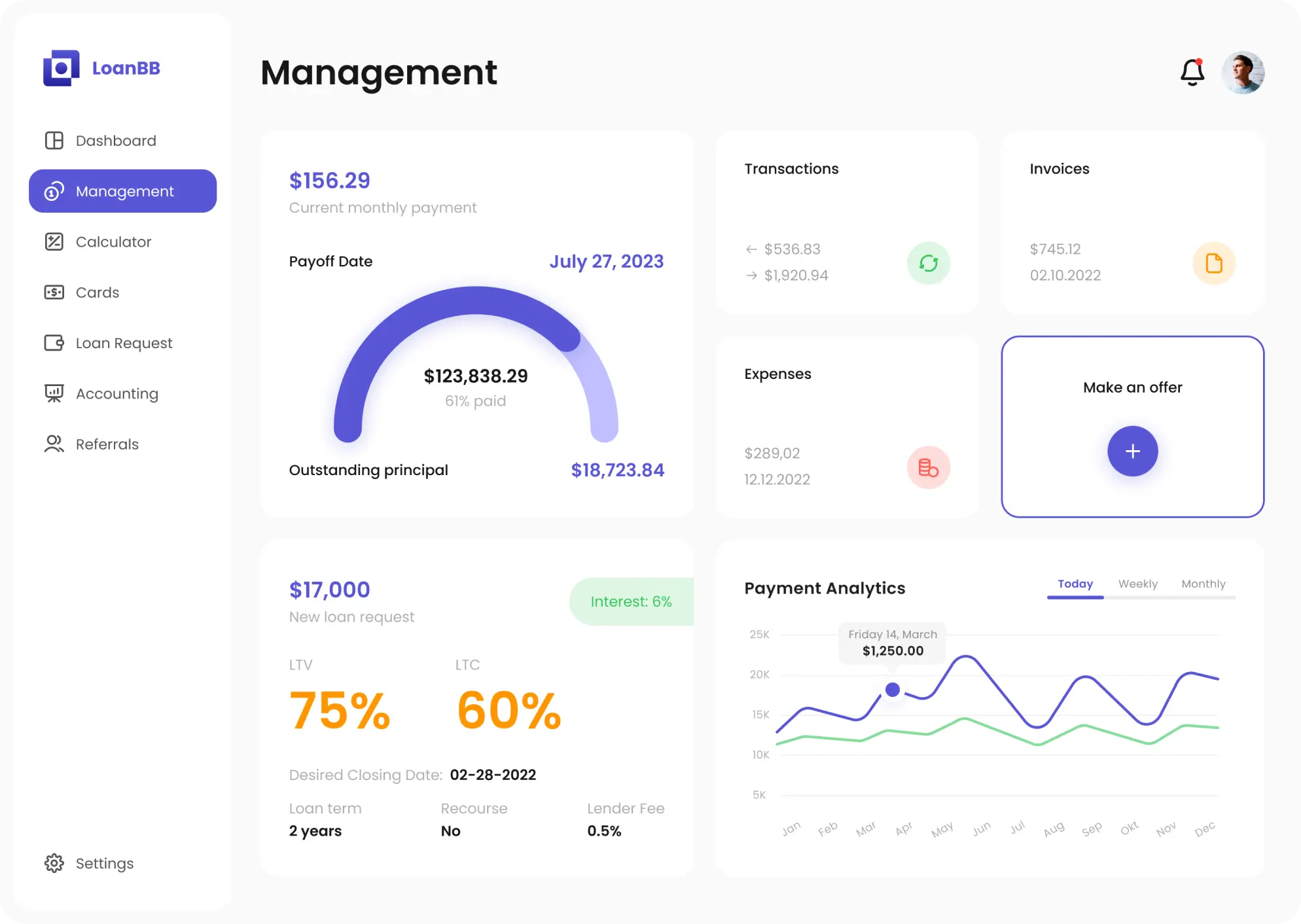

Loan management

The loan organization pipeline looks like this: The borrower fills out the loan application, the lender accepts it and grants the loan if they are satisfied with the offer and terms.

Online loan calculator

A borrower can enter the sum of money they need, and the calculator will show the loan period, annual percentage rate, and corresponding monthly payment amount.

Feedback form

Both borrowers and lenders can leave honest feedback about their experience to help others understand the quality, range, and returns of the loan.

Dashboards

We implemented dashboards for lenders and borrowers to easily navigate the platform and see their profile’s statistics

Challenges and solutions

User roles management

Problem: Some requests didn’t have the user access level segregated by user role. As a result, borrowers could have access to the lender’s functionality.

Solution: We have introduced the security improvement by adding access for each request with binding to both the token and user role.

Results

The platform is up and running. Good results of speed tests. Finished penetration testing. Positive user feedback.