- What we do

- Services

- Solutions

- Our Works

- Company

- Contact Us

March 10, 2020

SmartCenter – A Big Platform for Small Tax Firms

Meet SmartСenter – a special online platform that helps small tax firms organize their work. Combining a CRM system and a task manager, it keeps clients’ tax information in one place and tracks all the company’s activity.

Taxation, like any other process, requires order. Tax firms, especially small ones, suffer from an enormous amount of client-related information that must be organized and controlled. Handling this information physically can be hard enough, while electronic storage, where information can be easily misplaced, poses even more problems.

This is why our client came to us with the idea to create SmartCenter.

What is it?

SmartCenter is a specialized platform for small tax firms that combines a CRM (customer relationship management) system with a task manager to help tax firms gain control over client information and manage their current projects.

Why it’s needed

In the USA, the phrase “tax burden” is not just an economic term, it’s a reality. Filing taxes can be a true nightmare, especially for those who aren’t familiar with intricacies of the system. There are three levels to the U.S. tax system: federal, state and municipal. While federal tax requirements are the same nationwide, state and municipal taxes vary widely from place to place. In many cases, the same taxes are imposed at more than one level. For example, payroll taxes are paid both to federal and state governments at the same time.

Here we face a problem. With so many taxes on so many levels, people can easily get lost. The number of taxes and their complexity can become so great that companies can find them difficult to manage without help.

This is why tax firms are needed. Such companies, many of which are members of the National Association of Tax Professionals (NATP), provide the necessary services for taxpayers to keep their taxes organized.

Just like their clients who want to maintain control over their taxes, tax firms need to maintain control over their activities, and it is here that SmartCenter comes into play.

Inside SmartCenter

The SmartCenter platform consists of six components that combine in a simple and user-friendly interface. Here they are:

-

Dashboard

The main screen of the profile shows the entire work history of the tax firm. On this page, a user can view all projects and tasks and see whether they are currently in progress or overdue. Users can see not only the work progress of an individual employee but also track all the company’s activities.

-

Contacts

The Contacts section keeps each tax specialist’s client contact information at hand.

Here an employee can add and edit two types of contacts: business and individual. For both types, the user can add a contact photo, email, phone number and other information to make each client profile as detailed as possible.

If the tax firm already has a database of contacts, the necessary information can be easily imported from various sources such as QuickBooks, Xero, Office 365 and Gmail (or even easier – users can just upload a CSV file).

-

Work

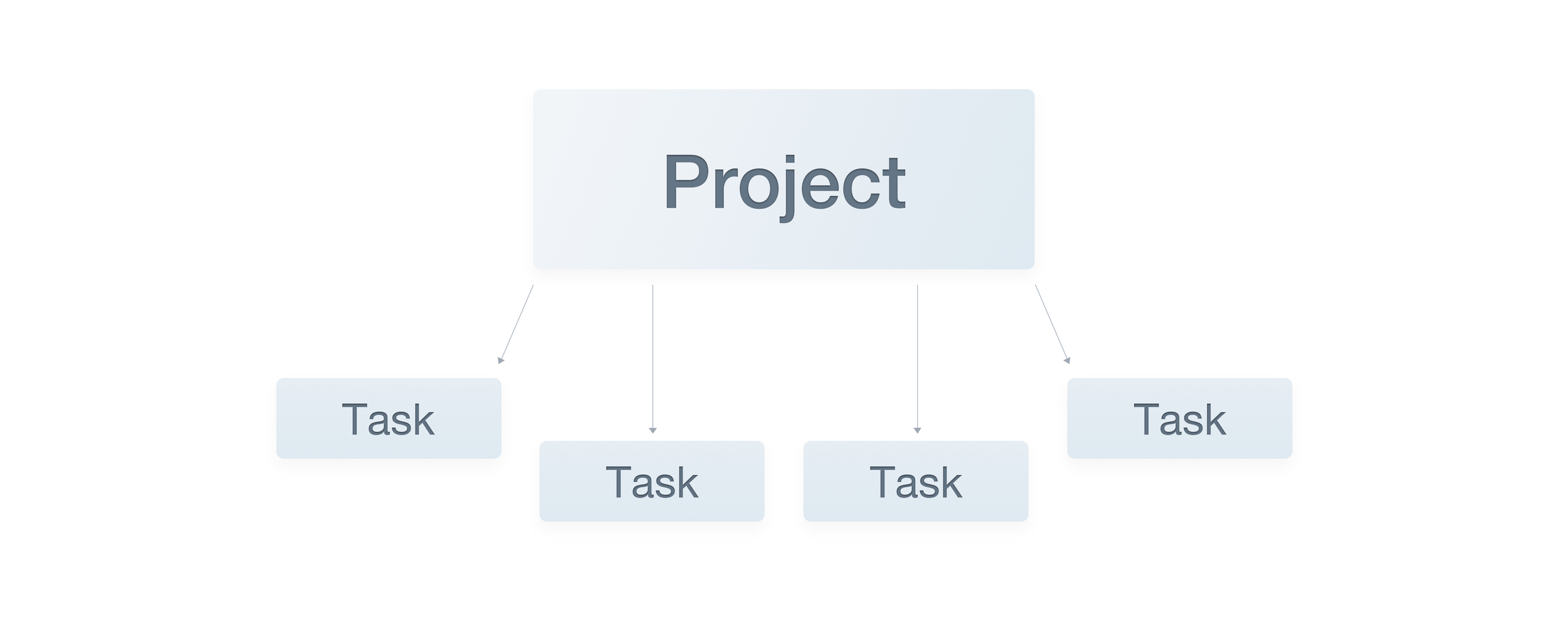

The Work section contains information about the projects and tasks of the tax firm.

Here project means a general entity that describes a certain taxable activity of the client, such as payroll, bookkeeping, individual tax return, and others. It consists of Tasks – small separate processes that help diversify the load and speed up the work. For example, if the project is a payroll, tasks could include a record request for the pay period, data review, entering pay period records into the payroll system and sending tax payments.

To avoid the need for tax firm employees to create new projects and tasks from scratch each time, SmartCenter comes with Templates – prepared lists of tasks that apply to different types of projects. If necessary, users can edit the templates (delete certain tasks or add new ones) or create and save their own templates. This feature saves employee time and helps organize platform usage.

-

Conversations

Here tax firm representatives can communicate directly with clients without intermediaries like social network messages or phone calls. There is no longer any need to scroll an entire database to find the phone number or email you need to talk to the client – everything is already in one place.

-

Documents

This part stores all the tax documentation a client needs in a single place.

-

Resources

This section contains a list of guides and articles for making the business successful along with some templates for documentation, like a Tax Engagement Agreement or a Client Rating Worksheet. This information can help new employees improve their knowledge of taxation and help experienced tax specialists optimize their work.

Team

The team consisted of five people:

- Full-stack developer

- Backend developer

- QA specialist (part-time)

- Project manager (part-time)

- Designer (part-time)

Time

The team needed six months to complete development.

Tools

Our team used Ruby on Rails for the backend, and the frontend was developed in Ember.js.

Ember framework

At the moment, the two most popular front-end frameworks are React and Angular. React is supported by Facebook, and Angular by Google. Some time ago there was a third competitor – Ember.js, which was supported only by a group of developers. The competition was too intense, so usage of Ember decreased significantly.

When the client came to us, a large portion of the app that was already written in Ember. We had two options at that point, to either rewrite everything from scratch in something more future-proof like React or to update the existing code to the newest version of Ember and continue developing.

Despite the fact that React is more future-proof, two factors made us question this option:

- Starting everything from scratch would consume more resources than updating Ember, causing the client to lose a lot of time and money.

- The client already had some customers who were using SmartCenter and transfering all their information to a new tool would make development even more complicated.

So, to save the client’s time, money and customers, we suggested updating the existing code.

Monetization strategy

SmartCenter has three subscription plans:

- Starter – $20/month per user

- Plus – $30/month per user

- Pro – $40/month per user

Each higher level adds something to the platform's functionality, like smart email integration, real-time internal team chat or client document sharing.

What we have now

Our team developed a user-friendly cloud-based platform that offers a CRM and a task manager in a single package. The platform helps tax firms control their activity and facilitates customer service.

To sum up

That's our story of developing a management platform for small tax firms. But this model (CRM+task manager) is not only relevant for taxes! Similar systems would be useful in every business area, from taxation to currency trading.

Organizing tasks and information can be very complicated. Many elements must be taken into account and no one is safe from mistakes. And when speaking about taxation, mistakes can be really dangerous. Proper organization order is very important. That's why we created SmartCenter: to keep the taxes under control.

Got a project in mind?

Fill in this form or send us an e-mail

Subscribe to new posts.

Get weekly updates on the newest design stories, case studies and tips right in your mailbox.